If you're looking into solar for your New York home or business, the first question on your mind is likely: "What's this actually going to cost me?" It's the most practical place to start, and understanding the numbers is key to making a smart decision.

On average, a solar panel installation in New York costs between $2.90 and $3.50 per watt. That means a standard 8-kilowatt (kW) system, which is a great fit for a typical family home on Long Island, will have an initial price somewhere between $23,200 and $28,000.

Now, before that number gives you pause, it’s critical to know that this is the gross cost—the price before New York's fantastic state and federal incentives kick in. The final price you'll actually pay out-of-pocket will be much, much lower. This guide will walk you through the real costs, the incredible savings, and how you can achieve energy independence.

Understanding Your Initial Investment in New York Solar

It’s easy to get sticker shock when you see a five-figure number. But it's helpful to reframe it: this isn't just a home improvement project. It's an investment in your energy future. You're essentially building a personal power plant on your roof, one designed to drastically cut or even completely wipe out your electric bill for the next 25-30 years.

For any homeowner on Long Island wrestling with PSEG's ever-rising rates or a business in NYC getting hit with Con Edison's peak demand charges, this investment starts making powerful financial sense very quickly. By generating your own clean power, you take control of your energy costs, achieve independence from the utility, and contribute to a healthier environment.

The great news is that solar is more accessible than ever. The cost to install solar panels has plummeted by an incredible 99% since the 1970s. While prices in the U.S. (typically $2 to $3 per watt) are a bit higher than in other parts of the world due to "soft costs" like permitting and labor, the long-term savings are undeniable for New Yorkers. You can dig deeper into these global solar statistics on GreenMatch.co.uk.

Estimated NY Solar Installation Costs Before Incentives

To give you a clearer picture, here’s a quick breakdown of what you might expect to see for different system sizes in the NYC and Long Island area. These are just ballpark figures to get you started.

| System Size (kW) | Ideal Home Size (sq. ft.) | Estimated Gross Cost (NYC/Long Island) |

|---|---|---|

| 6 kW | 1,200 – 1,800 sq. ft. | $17,400 – $21,000 |

| 8 kW | 1,800 – 2,500 sq. ft. | $23,200 – $28,000 |

| 10 kW | 2,500 – 3,500 sq. ft. | $29,000 – $35,000 |

| 12 kW | 3,500+ sq. ft. | $34,800 – $42,000 |

Again, remember that this is just the starting line. The real magic happens when we start subtracting the tax credits and rebates available to you.

This initial cost is just one piece of the puzzle. The true value emerges when you subtract the substantial tax credits and rebates available, which can cut your net cost by up to 50% or more.

So, what causes the price to fluctuate within these ranges? Several key factors will shape your final quote.

- The Equipment You Choose: High-efficiency panels and top-tier inverters cost more upfront but generate more power over their lifetime, giving you a better return on investment.

- Your Roof's Characteristics: A simple, south-facing roof is straightforward. A complex roof with steep pitches, multiple angles, or older shingles might require more labor and specialized mounting gear.

- Adding Battery Storage: If you want backup power for blackouts and true energy independence, adding a battery like the Tesla Powerwall is an additional investment. It adds tremendous value and resilience but will increase the initial project cost.

Think of the gross cost as step one. Next, we’ll break down what’s actually inside a typical quote and then get to the good stuff—the incentives that make solar such a smart move for New York homeowners and businesses.

Ready to see what your specific numbers look like? Contact NY Essential Power today for a free, no-obligation solar quote.

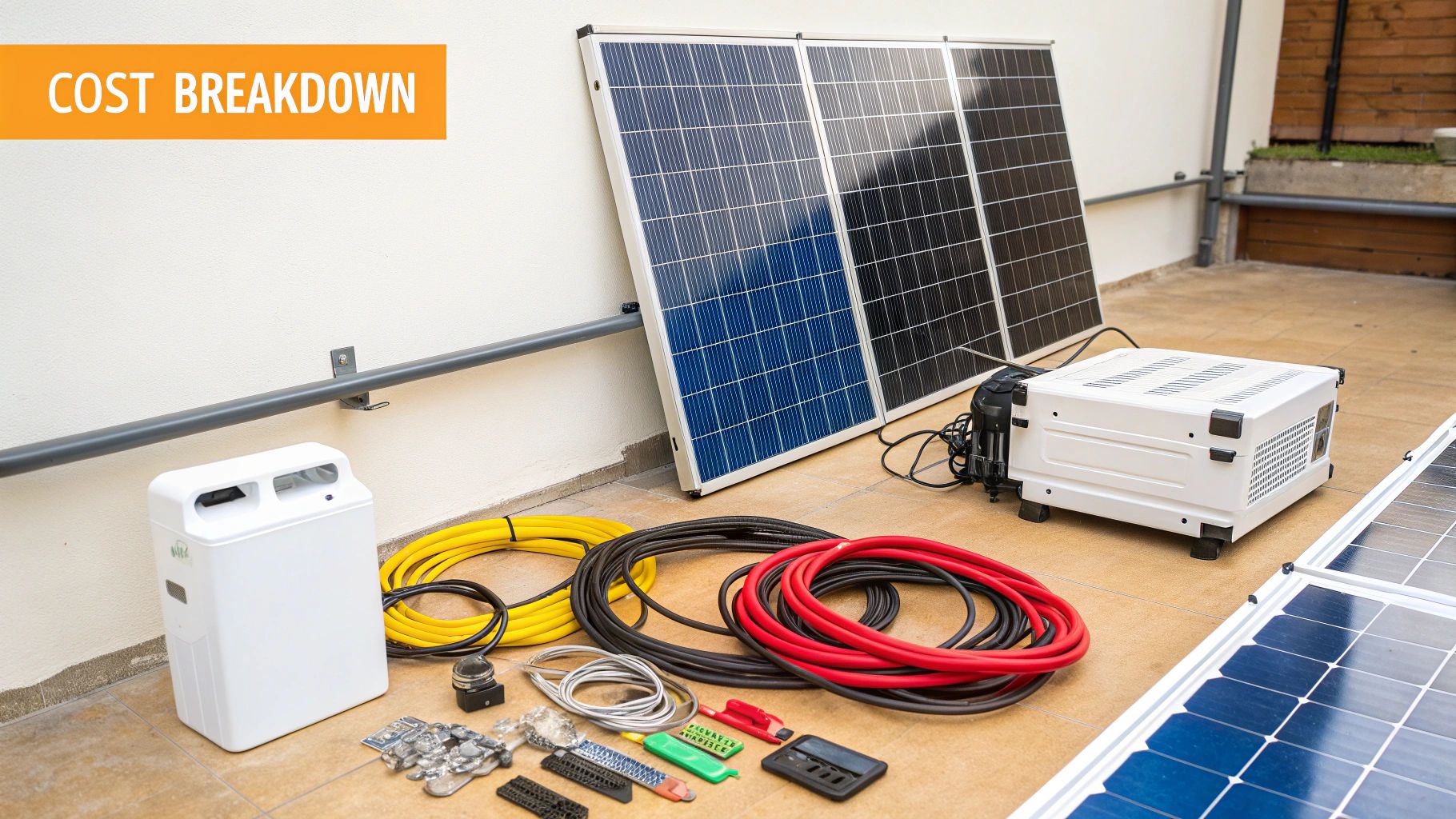

What's Actually in a Solar Quote? A Breakdown

Getting your first solar quote can feel a bit like reading a foreign language. There are many line items and technical terms that all add up to the final price. So, let's pull back the curtain and look at what you’re actually paying for.

Think of it this way: you’re not just buying solar panels. You’re investing in a complete, custom-engineered power generation system. Just like building a house, the total cost isn't just the lumber and nails; it’s also the architects, the skilled builders, and the permits. A solar project is broken down into two main buckets: hard costs (the physical equipment) and soft costs (everything else it takes to get it running).

Unpacking the Hardware Bill

This is the tangible technology that will be on your roof for the next 25+ years, quietly turning sunlight into savings and clean energy.

Here’s a look at the key components:

- Solar Panels: These are the heart of the system. You’ll encounter options like monocrystalline panels, known for their sleek, all-black look and higher efficiency, making them great for smaller roofs. You might also see polycrystalline panels, which are slightly more budget-friendly but less powerful.

- Inverters: If the panels are the heart, the inverter is the brain. It takes the direct current (DC) power the panels create and converts it into the alternating current (AC) power your home’s appliances use. A standard string inverter is a reliable, cost-effective choice, while microinverters or power optimizers are a premium upgrade that can boost energy production, especially if your roof has sections that get shade.

- Racking and Mounting: This is the unsung hero. It's the heavy-duty framework that bolts the panels securely to your roof, engineered to handle everything from Long Island’s coastal winds to a heavy Nor'easter snow load.

- Battery Storage (Optional): Want to keep the lights on during a blackout? Adding a battery like a Tesla Powerwall lets you store the extra solar energy your system produces. You can then use that power at night or during an outage for true energy independence. You can learn more about how battery storage options work for your home.

It’s easy to assume the panels are the biggest expense, but that’s not the whole story. All the equipment combined typically makes up about 46% of the total project price. The specific gear you choose can easily swing your final cost by thousands, which is why it's worth discussing the options with your installer. You can read more about how equipment choices impact solar pricing on EnergySage.com.

The Major Role of Soft Costs in New York

While the hardware is important, the "soft costs" are where the other half—or often more—of your investment goes. These are all the behind-the-scenes services, labor, and administrative hurdles required to get your system designed, approved, and switched on.

Soft costs are a significant reason why solar prices vary. They include everything from the design and engineering of your system to the skilled labor required for a safe and efficient installation.

For a homeowner in Nassau County or a business in Queens, these costs are non-negotiable and absolutely essential. They include things like:

- Skilled Labor: You’re paying for the expertise of certified electricians and experienced installers who know how to work safely on your roof and ensure every connection is perfect.

- Permitting Fees: Every town, from Huntington to Brookhaven, has its own unique set of rules and required permits. A good local installer knows how to navigate this red tape efficiently.

- Interconnection Process: This is the critical step of getting permission from your utility—PSEG Long Island or Con Edison—to connect to the grid. It’s a formal process that ensures you get properly credited for the extra energy you send back. Check out our guide to understanding the solar installation process for a step-by-step look.

When you understand that a solar quote covers everything from the panel on your roof to the permit filed at town hall, you see the full picture. It's not just a product; it’s a full-service construction project that builds a long-term, power-producing asset for your property.

How NY Incentives Slash Your Final Price Tag

That initial price you see for a solar installation? Think of it as the sticker price on a car—it’s just the starting point. For anyone living in New York, the real conversation begins when we factor in the powerful federal and state incentives designed to make clean energy a no-brainer investment.

These programs can dramatically chop down your final solar panel installation costs. We're not talking about a small discount, either. By stacking these incentives, many homeowners and businesses across Long Island and NYC can slash their net cost by 50% or more. This is where the numbers get really interesting.

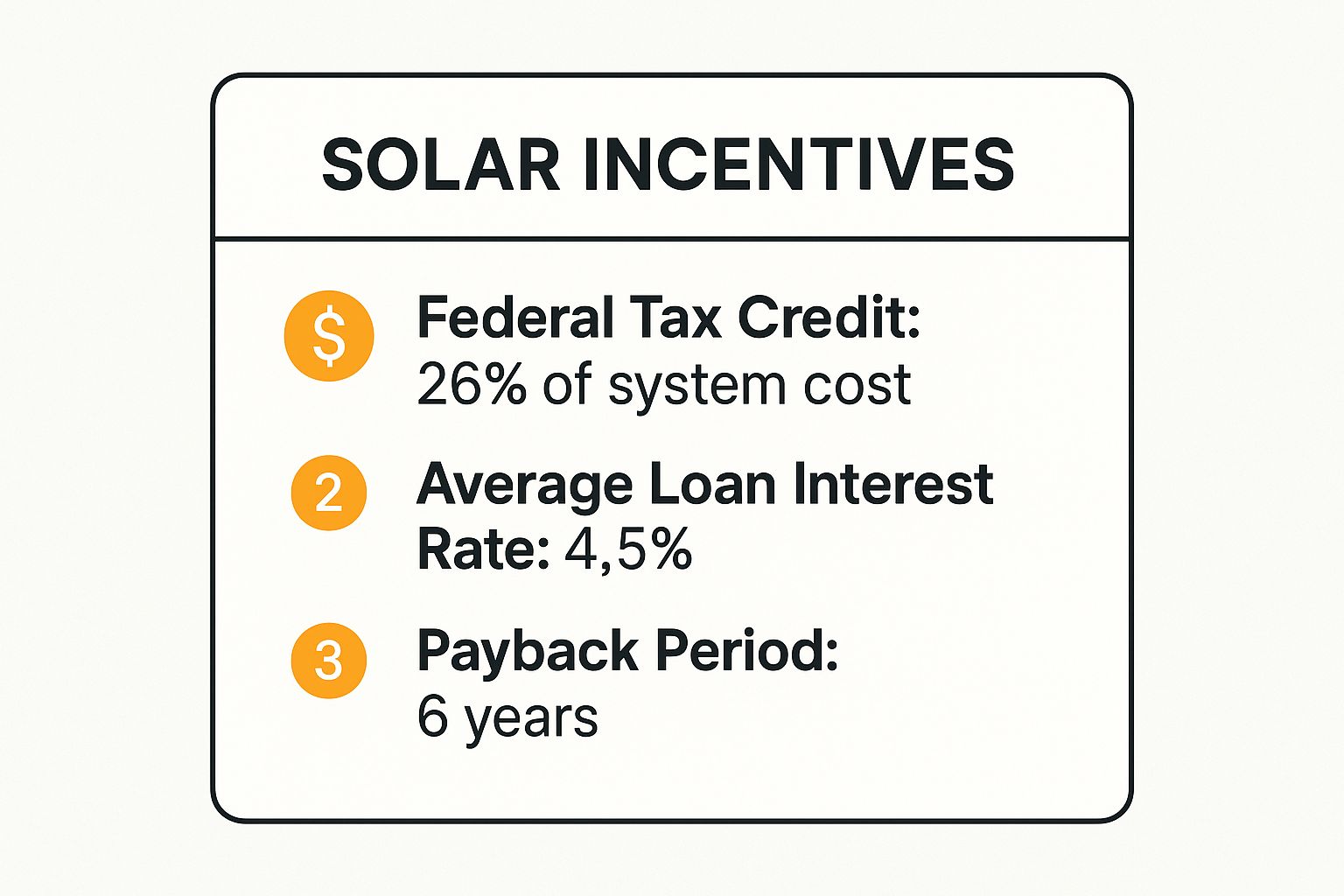

The Federal Solar Investment Tax Credit (ITC)

First up is the heavy hitter: the federal government's Solar Investment Tax Credit, or ITC. This isn't just a simple deduction. It's a dollar-for-dollar credit that directly reduces what you owe on your federal income taxes.

Right now, the ITC lets you claim 30% of your total system cost. Let's put that into perspective. For a $25,000 system, that’s a $7,500 credit coming straight off your tax bill. This one incentive alone makes a massive dent in the upfront cost and is a huge reason why solar offers such a fantastic return on investment.

When you look at the big picture—a substantial federal credit, smart financing, and a quick payback period—it becomes clear just how accessible and financially sound going solar is for New Yorkers.

New York State's Powerful Solar Programs

New York doesn't just rely on the federal government to sweeten the deal. The state has its own robust set of programs that bring your out-of-pocket expenses down even further.

The NY-Sun Megawatt Block Incentive

This is New York's flagship rebate program, run by the New York State Energy Research and Development Authority (NYSERDA). It’s a straightforward, upfront rebate that’s based on the size of your solar system. The exact amount varies by region and is designed to step down as more solar gets installed, so timing is key.

- Con Edison Territory (NYC & Westchester): This region often sees some of the highest incentive rates because of higher local energy costs and grid demand.

- Long Island (PSEG-LI): Residents here also benefit from a strong rebate, though the specific per-watt amount might differ from the Con Edison block.

- Upstate Regions: Other areas have their own dedicated incentive blocks, making sure everyone across the state benefits.

The best part? The NY-Sun rebate is paid directly to your installer (like us at NY Essential Power). We then pass that full discount straight to you, lowering your total contract price before you even pay a dime.

New York State Solar Energy System Equipment Credit

As if the federal credit and NY-Sun rebate weren't enough, the state gives you one more tax break. You can claim 25% of your system costs, up to a maximum of $5,000, against your New York State income taxes. It’s another powerful tool that directly shrinks your tax bill and speeds up your savings.

For a deep dive into how all these programs fit together, check out our complete guide on 2025 solar incentives and tax credits for New York homeowners.

To make sense of it all, here's a quick summary of the major financial perks available to you.

Key Solar Financial Incentives for NY Residents

| Incentive Name | Governing Body | Benefit Type | Key Details for New Yorkers |

|---|---|---|---|

| Solar Investment Tax Credit (ITC) | Federal (IRS) | Tax Credit | A 30% credit on the total system cost, directly reducing your federal income tax liability. |

| NY-Sun Megawatt Block Incentive | NYSERDA | Upfront Rebate | A per-watt cash rebate paid to your installer and passed directly to you as a discount. |

| NY State Solar Energy System Equipment Credit | New York State | Tax Credit | A 25% credit on system costs (capped at $5,000), reducing your state income tax liability. |

| Property Tax Exemption | New York State | Tax Exemption | Prevents your property taxes from increasing for 15 years due to the added home value. |

| Modified Accelerated Cost-Recovery System (MACRS) | Federal (IRS) | Tax Deduction | For businesses, allows for accelerated depreciation of the solar system's value. |

These programs work together to make your switch to solar incredibly affordable.

Don't Forget These Extra Benefits

The savings don't stop with the big-name credits and rebates. New York has put other smart policies in place to make sure your investment is protected and profitable from day one.

A huge one is the 15-year property tax exemption. Everyone knows that solar panels boost your home's value. But thanks to this state law, your property assessment—and by extension, your property taxes—can't go up because of your new solar installation.

For businesses, the deal gets even better. Commercial property owners can use the Modified Accelerated Cost-Recovery System (MACRS) to depreciate the value of their solar system over just five years, creating a major tax shield.

When you add it all up, that initial solar panel installation cost looks a lot less intimidating. It stops being a major expense and becomes what it truly is: a smart, government-backed investment in your energy independence.

Choosing Your Solar Financing Path

Alright, so you’ve seen how New York’s incredible incentives can knock a huge chunk off the sticker price. The next question is a big one: what’s the best way to pay for it?

Good news—you have options. There isn’t a single "right" way to do it; the best path for you really depends on your financial situation and your goals. Let’s walk through the most common ways people fund their switch to solar.

Cash Purchase: The Path to Maximum ROI

If you have the capital available, paying for your system with cash is the straightest line to the biggest savings. It's simple, clean, and gets you the best long-term return on your investment.

When you buy your system outright, you completely sidestep interest payments. This means you’ll reach your break-even point much faster. From day one, you own the equipment, which means every single incentive—federal tax credits, state rebates, you name it—goes directly into your pocket. For those with the capital, it turns your roof into a high-performing asset that pays you back for years and years.

Solar Loans: Own Your System with No Money Down

This is, by far, the most popular route for homeowners in New York. A solar loan gives you the best of both worlds: you get all the benefits of owning your system without having to use your savings for the upfront cost.

The goal of a good solar loan is to replace your utility bill with a lower, fixed monthly payment. Think of it this way: instead of sending a fluctuating check to PSEG or Con Edison every month, you’re making a predictable payment on an asset that you own.

We see this all the time with our clients. Let's say your average PSEG bill is $250 a month. We can often set up a loan payment around $180. Just like that, you're saving $70 every single month from the get-go.

That’s the "day-one savings" model in action, and it’s a powerful reason why so many people choose this path. You get the increased property value and energy freedom of ownership while actually improving your monthly cash flow. For a deeper dive, check out our guide to the top solar financing options for Long Island homeowners.

Leases and PPAs: An Alternative Approach

While they have become less common as ownership has become more accessible, solar leases and Power Purchase Agreements (PPAs) are still out there. In a nutshell, these are rental agreements—you don't own the panels on your roof.

- Solar Lease: You pay a flat monthly rate to a solar company for the use of their panels. You get the clean energy they produce, but the company keeps the tax credits and other ownership perks.

- Power Purchase Agreement (PPA): This is slightly different. Instead of a fixed rent, you agree to buy the power the system produces at a set price-per-kilowatt-hour, which is usually lower than the utility's rate. The third-party company still owns and maintains everything.

These options can make sense for someone who can't take advantage of the tax credits or simply wants a zero-maintenance arrangement. But it's important to know the trade-offs: leases and PPAs don't add value to your home, and the long-term savings just don't stack up against owning the system yourself. We’re here to help you crunch the numbers on every option to make sure you land on the one that truly works for you.

Crunching the Numbers: Your Long-Term Solar Savings

So, we've talked about the upfront costs and the great incentives available. But the real question on everyone's mind is, "What's in it for me down the road?" This is where going solar stops feeling like an expense and starts acting like a powerful financial asset—one that pays you back for decades.

Figuring out your return on investment (ROI) isn't just about year one. It’s about seeing the big picture and pinpointing the exact moment your system has paid for itself.

The magic happens when you compare your life now with your future powered by the sun. For those of us on Long Island or in NYC, that means looking at our ever-climbing bills from PSEG and Con Edison. Their rates are anything but stable; historically, electricity prices here jump by an average of 2-4% every single year. A solar system is your way of hitting the pause button on that, locking in your energy costs and protecting you from that inflation for the next 25 years or more.

From the day it’s switched on, your system isn't a cost center—it's a savings generator.

What Goes Into Your Solar ROI Calculation?

To get a clear forecast of your savings, we need to look at a few key ingredients that determine how quickly you break even and how much you'll save over the system's life.

- Your Current Electric Bill: This one's simple—the higher your bill, the faster your payback. A family in Suffolk County with a $300 monthly bill has a lot more to gain than a family spending $100.

- How Much Power Your System Makes: We don't just guess. Our team designs a system specifically for your roof's orientation and the local sun exposure to nail down a solid estimate of your annual production in kilowatt-hours (kWh).

- The Value of Net Metering: In New York, net metering is a game-changer. When your panels are cranking out more power than you can use, the excess gets sent right back to the grid. PSEG or Con Ed credits you for every kWh, which you can draw from at night or on cloudy days. This ensures you get full financial value for 100% of the power your system produces.

Put these three factors together, and a clear financial picture starts to emerge.

A Real-World Example: A Suffolk County Home

Let's make this real. Imagine a family living in Smithtown, Suffolk County. Before solar, their electric bill averaged $280 per month, which adds up to $3,360 a year.

They decide to install an 8 kW solar system. After applying all the federal and state incentives, their final cost is $16,000. We designed this system to cover just about all their yearly electricity needs. In the very first year, their utility bill plummets to just the small monthly service fee of around $15. That’s an annual savings of roughly $3,180.

With $3,180 saved each year on a $16,000 investment, their system pays for itself in just over five years ($16,000 ÷ $3,180 = 5.03 years). After that break-even point, they're getting nearly free electricity for the rest of the system's 25+ year lifespan.

And that's not even the whole story. This calculation doesn't factor in the annual rate hikes from the utility. As PSEG's prices inevitably climb, this family's savings will actually grow larger every year, making their return even better. Over 25 years, this single investment is projected to save them over $90,000. For a deeper dive into the numbers, check out our analysis of the ROI on solar in Suffolk County.

This is how a solar installation becomes one of the smartest financial moves a New Yorker can make. It gives you energy independence, acts as a shield against inflation, and adds serious value to your property—all while doing something good for the planet.

Ready to see what your own savings projection looks like? Contact NY Essential Power for a personalized quote.

Got Questions About Solar Costs? We've Got Answers.

When you're thinking about going solar, the numbers are what matter most. It’s a big decision, and you deserve clear, honest answers. We’ve pulled together the most common questions we hear from homeowners across Long Island and NYC to help you understand the real costs and benefits.

So, What's the Real Cost for a Solar System on Long Island?

Let's talk numbers. For a typical Long Island home, an 8 kW system is a common size. The upfront, or "gross," cost for a system like this usually lands somewhere between $24,000 and $32,000.

But nobody pays that full price. After you apply the 30% federal tax credit and the NY-Sun rebate, you'll see that number drop significantly—often by 40-50%. That brings your final cost down to a much more accessible $12,000 to $18,000 range. Keep in mind, the final price tag will always depend on your home's unique energy needs, the condition of your roof, and the specific equipment you select.

Will My Property Taxes Go Up After I Install Solar?

Nope! This is one of the best parts about going solar in New York. The state offers a 15-year property tax exemption on the value your solar panel system adds to your home.

So, while solar absolutely boosts your home's resale value, you won't get hit with a bigger tax bill for making such a smart investment. It’s a key financial safeguard that makes the decision to go solar that much easier.

What Happens When My Panels Make More Power Than I'm Using?

Great question! Any extra energy your panels generate doesn't go to waste. Thanks to a state policy called net metering, that surplus power is sent back to the grid, and your utility company gives you credits on your bill.

Think of PSEG or Con Edison as an energy bank. You "deposit" excess solar power during the day and "withdraw" it at night or on cloudy days. This system ensures you get full value for every bit of power your panels produce, which is how many homeowners end up with little more than a small monthly service fee on their electric bill.

Are There Special Solar Rules I Need to Know About in NYC?

Yes, absolutely. Installing solar in New York City comes with its own set of rules, especially for the flat roofs you see on so many townhouses and commercial buildings. There are specific permitting, structural, and fire code requirements from the NYC Department of Buildings (DOB) and the FDNY that have to be followed to the letter.

This is where having a seasoned local installer makes all the difference. We handle every bit of that complex permitting and paperwork for you, making sure your project is safe, compliant, and completely hassle-free from start to finish.

Ready to see what the numbers look like for your home or business and finally break free from high energy bills? The team at NY Essential Power is here to give you a free, no-pressure quote and walk you through your potential savings, energy independence, and environmental benefits.