New Yorkers face some of the highest energy costs in the country, a reality that can feel daunting for both homeowners and businesses. Fortunately, a powerful solution exists: a combination of federal and state solar panel incentives that creates a clear path toward energy independence and substantial savings. These financial benefits make solar a surprisingly accessible and intelligent investment for properties across New York, from Long Island to Buffalo.

How New York Solar Incentives Make Going Solar Affordable

New York State is a national leader in climate action, and a key part of that commitment is making renewable energy a financially appealing choice for everyone. Because our electricity rates are so high, the potential for savings with solar is massive. By strategically combining available incentives, you can slash the upfront cost of a solar installation and achieve a much faster return on your investment.

This guide will break down the complete financial picture for you, piece by piece. We'll show you exactly how these programs work together to your benefit. Whether you're a homeowner tired of unpredictable PSEG bills in Suffolk County or a commercial property manager in Queens looking to stabilize operating costs, understanding these incentives is your first step toward energy freedom.

Why These Programs Exist

The motivation behind these incentives is straightforward: accelerate New York's transition to clean energy. By offering direct financial rewards, both the state and federal governments help shoulder the initial investment, bringing the long-term benefits of solar within reach for more property owners. This approach is critical for helping New York meet its ambitious clean energy goals while empowering residents and business owners to take control of their energy costs.

When you combine federal, state, and local programs, you can often cover 50% or more of your total solar system costs. This creates an incredible opportunity to invest in a valuable asset that pays for itself through energy savings.

What You Can Expect to Gain

The advantages of using solar incentives in New York are two-fold, offering immediate value and long-term financial security. For homeowners, this means a significantly shorter payback period and more money in your bank account every month. For instance, a homeowner exploring residential solar in Lake Ronkonkoma could see their project become profitable years sooner than they imagined.

Here’s a quick look at the main perks you'll unlock:

- Significant Cost Reduction: Lower the initial price of your solar panel system with direct rebates and tax credits.

- Increased Property Value: A solar installation is a major property upgrade that boosts its appeal to future buyers, and New York ensures it won't increase your property taxes for 15 years.

- Energy Independence: Break free from your reliance on the grid and shield your budget from constantly rising utility rates.

- Environmental Impact: Play an active role in building a cleaner, more sustainable energy future for all New Yorkers.

Ready to see how these incentives stack up for your property? Contact NY Essential Power today for a free, no-obligation solar analysis. Our experts will build a custom proposal showing you exactly how much you stand to save.

Claiming the 30% Federal Solar Tax Credit

The bedrock of any solar project in New York is the Federal Solar Tax Credit. Officially named the Residential Clean Energy Credit, it provides a massive discount on your entire project.

This is not a simple deduction; it's a powerful, dollar-for-dollar reduction of the federal income tax you owe. This is the foundational incentive that all other state and local benefits stack on top of, making it the single most impactful financial tool for slashing the upfront cost of a solar installation for both homes and businesses.

For example, if you owe the IRS $7,000 in taxes and qualify for a $6,000 credit, your tax liability plummets to just $1,000.

What Costs Are Eligible for the Credit?

One of the best aspects of the federal credit is its comprehensive nature. It doesn't just cover the solar panels themselves. It applies to the total gross cost of your system, ensuring you receive the maximum possible credit for your investment.

Eligible expenses include:

- Solar Panels: The cost of the photovoltaic (PV) panels generating your power.

- Battery Storage: Equipment like a Tesla Powerwall that stores excess solar energy for use during power outages or at night.

- Installation Labor: The cost of site preparation, assembly, and professional installation services.

- Balance-of-System Equipment: All other critical components, such as inverters, wiring, and mounting hardware.

- Permitting and Inspection Fees: The administrative costs required to get your system approved and connected to the grid.

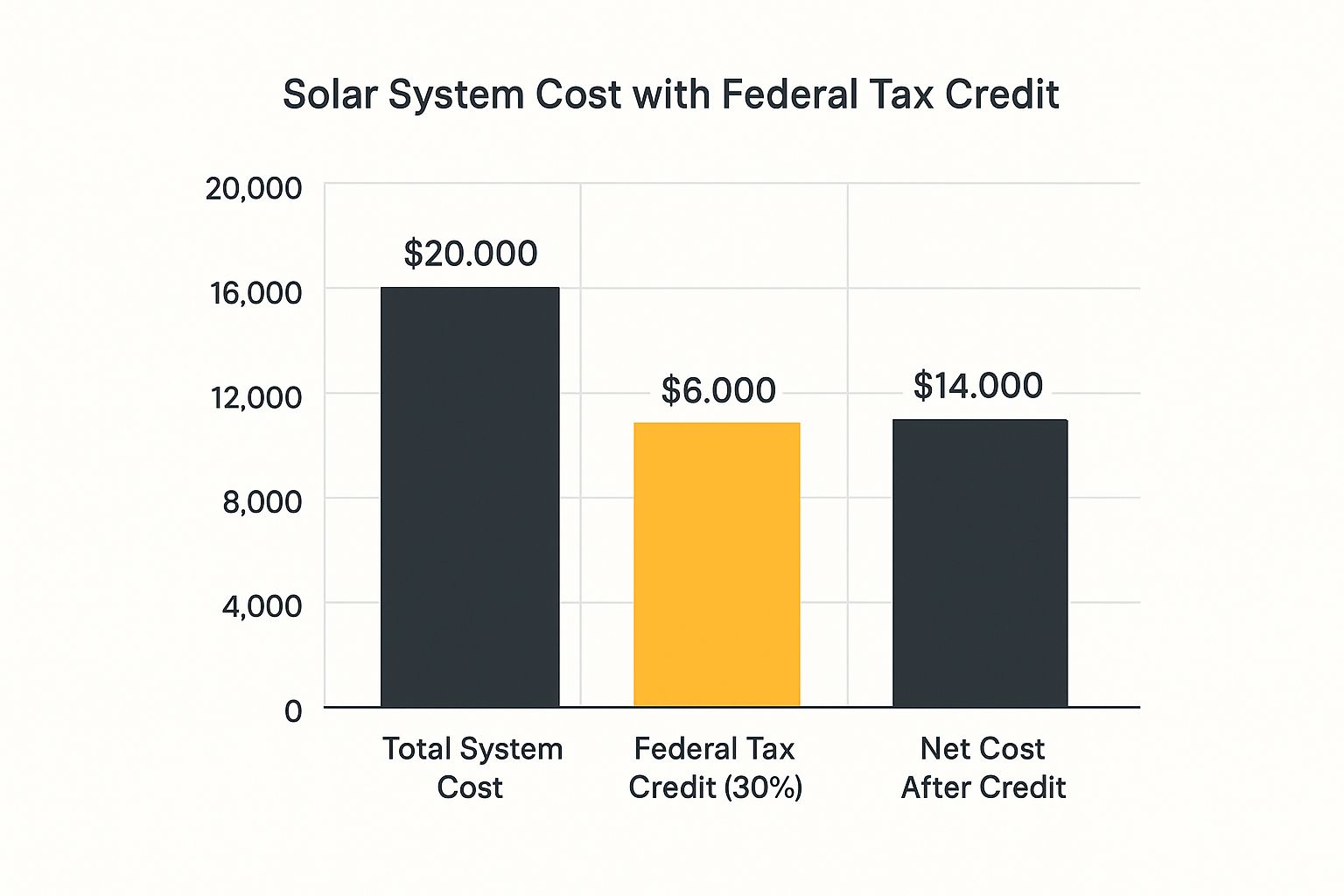

A Practical Example for a New York Home

Let's walk through a real-world scenario. Imagine you're a homeowner in Ronkonkoma, and the total cost for your solar system—including panels, a battery, and installation—is $20,000. The federal credit allows you to claim 30% of that entire amount.

Here's the simple math:

$20,000 (Total System Cost) x 0.30 (30%) = $6,000 Federal Tax Credit

That $6,000 is subtracted directly from your federal tax bill. While it isn't a rebate check, it has the same positive impact on your finances. Right away, the credit drops the net cost of your system to just $14,000.

This chart drives home how dramatically the 30% federal credit lowers the cost of a typical solar project.

As you can see, this single incentive makes solar significantly more affordable before we even factor in New York's state and local programs.

How to Secure Your Federal Credit

Claiming the credit is a straightforward part of filing your annual federal taxes using IRS Form 5695, Residential Energy Credits. If the credit you earn is more than what you owe in taxes for one year, the remaining balance can be rolled over to reduce your tax liability in future years.

The federal government and New York State are working in tandem to make solar an easy choice. The Residential Clean Energy Credit allows homeowners to claim up to 30% of installation costs, with this rate currently set for systems installed before the end of 2032. When combined with New York's own incentives, the numbers become incredibly compelling. You can discover key insights about New York solar benefits and see how it all works together.

To take full advantage of all available solar panel incentives in New York, it's wise to get started soon. Contact NY Essential Power for a free solar quote, and our team will walk you through every step to ensure you maximize every dollar of savings.

Maximizing Savings With New York State Programs

The 30% federal tax credit is a fantastic starting point, but New York doesn’t stop there. The state has layered its own powerful incentives on top, making solar an incredibly smart financial move for property owners. Think of it as a one-two punch for knocking out high energy costs.

By stacking these state-level benefits with the federal credit, you can dramatically reduce the upfront cost of your solar panel system and begin saving money much faster.

Let's break down the two main incentives every New Yorker considering solar needs to know about: the NY-Sun Megawatt Block Incentive and the New York State Solar Energy System Equipment Credit.

The NY-Sun Megawatt Block Incentive

This is best understood as a straightforward, upfront cash rebate that directly lowers the price of your installation. Managed by the New York State Energy Research and Development Authority (NYSERDA), its purpose is to provide an immediate discount based on the size of your system.

The program operates in regional "blocks." Each block has a set amount of funding, and as more people in an area go solar, the block fills up. Once full, the incentive amount for the next block is typically lower. This first-come, first-served structure means starting your project sooner rather than later often locks in a better rebate.

The NY-Sun block system is designed to reward early adopters. The state created the incentive to decrease as solar becomes more common, so acting now ensures you receive the most generous rate available.

The rebate amount depends on your location. A project in Upstate New York will receive a different rebate than one in Con Edison’s territory. The NY-Sun Program is a key solar panel incentive for New York, with homeowners generally expecting between $0.15 and $0.20 per watt, and even more available for income-eligible households.

While this dynamic program has been highly successful, it is always evolving. For instance, some areas like Long Island are no longer eligible for this specific rebate due to high solar adoption rates. You can always learn more about New York's regional solar benefits to see how these programs are adapting.

The best part? NYSERDA pays this rebate directly to your certified installer (like NY Essential Power). We then pass those savings directly to you as a lower contract price. We handle all the paperwork, making the process completely seamless for you.

The New York State Solar Energy System Equipment Credit

In addition to the NY-Sun rebate, the state offers another significant benefit at tax time. The New York State Solar Energy System Equipment Credit allows you to claim 25% of your total solar installation costs, capped at a maximum of $5,000.

This is a true tax credit—a dollar-for-dollar reduction of your state tax liability, not just a deduction. It functions just like the federal credit but applies to your New York State taxes, allowing you to "double-dip" and reduce your tax bill at both the federal and state levels.

To claim this credit, you’ll file Form IT-255 with your state income tax return. If the credit exceeds your tax liability for one year, you can carry the leftover amount forward for up to five years.

This table provides a quick comparison of the main incentives available.

Comparing Key New York Solar Incentives

| Incentive Name | Incentive Type | Maximum Value / Rate | Who It's For |

|---|---|---|---|

| Federal Solar Tax Credit | Federal Tax Credit | 30% of total system cost (no cap) | Homeowners and businesses who own their system |

| NY-Sun Megawatt Block | State Rebate | $0.15 – $0.20 per watt (varies by region) | Homeowners in eligible NYSERDA regions |

| NY Solar Equipment Credit | State Tax Credit | 25% of system cost (up to $5,000) | New York homeowners who install solar panels |

Seeing them side-by-side highlights how New York's programs are designed to complement the federal credit, providing both an upfront discount and a significant tax-time reward.

How State and Federal Incentives Stack Up

Let’s return to our example of a $20,000 solar system for a home in Ronkonkoma to see the combined power of these incentives.

Here’s the simple math:

- Initial System Cost: $20,000

- Federal Solar Tax Credit (30%): $6,000

- New York State Tax Credit (25%, capped): $5,000

- Total Tax Credits: $6,000 (Federal) + $5,000 (State) = $11,000

Just like that, tax credits alone chop the net cost of that $20,000 system down to only $9,000. If that home were also in a region eligible for an NY-Sun rebate, the final cost would be even lower. This layered financial strategy is what makes solar such a compelling and affordable investment across the state.

Ready to see how these incentives can work for your specific property? Contact NY Essential Power today for a free solar quote and a detailed savings analysis.

Understanding Long-Term Financial Benefits

The savings from solar panel incentives in New York don't stop after installation. The initial tax credits and rebates are just the beginning. The true power of solar is a long-term investment that keeps paying dividends for decades.

Two key programs drive this long-term value: Net Metering and the Solar Property Tax Exemption. They are the unsung heroes that ensure your system generates financial returns for years to come.

Net Metering: Your Energy Savings Account

Net Metering works like an energy savings account. On a bright, sunny afternoon in New York, your panels often produce more electricity than your property needs.

Instead of wasting that surplus power, Net Metering allows you to send it back to the grid. Your utility company—whether it’s PSEG on Long Island or Con Edison in NYC—tracks this surplus and gives you credits on your bill.

Later, at night or on a cloudy day, you draw power from the grid as usual. The key difference is that you use your banked credits to offset the cost. This brilliant system ensures you get full value for every kilowatt-hour your panels produce, often slashing your electric bills or even eliminating them entirely. Your roof becomes a financial asset.

The Solar Property Tax Exemption

A common question from property owners is, "Will solar panels increase my property taxes?" It's a valid concern, as you're adding a significant upgrade that increases your property's value.

Fortunately, New York State has you covered. The Solar Property Tax Exemption prevents your property assessment from increasing due to your solar installation for a full 15 years. You can add thousands of dollars of value to your home or commercial building without paying a dime more in property taxes for that specific improvement.

This exemption is one of the smartest parts of New York's solar policy. It allows you to enjoy the full financial upside of your investment without the penalty of a higher tax bill, making the decision to go solar much easier.

This protection is especially valuable in high-tax areas like Long Island and Westchester County. You get a more valuable, efficient property without the usual tax headache that accompanies major upgrades.

Calculating Your Long-Term ROI

When you combine these benefits, the financial case for solar becomes incredibly compelling. Upfront incentives make it affordable, while ongoing programs accelerate your payback period. To understand the full potential, it helps to calculate your return on investment.

New York's high electricity rates make the savings from solar even more dramatic. A typical 5 kW residential solar system in New York might have an initial price of around $18,500. After the 30% federal credit, that drops to about $12,950. Over 20 years, that same system could save a homeowner an estimated $22,120 on electricity.

This is what makes the solar panels vs. traditional energy on Long Island debate so compelling. Once you factor in all the credits, rebates, Net Metering, and the property tax exemption, going solar becomes a clear financial win.

Your Step-by-Step Plan to Secure Solar Savings

Knowing about the powerful solar panel incentives in New York is one thing; putting that money in your pocket is another. This clear, actionable roadmap will guide you from initial curiosity to generating clean energy and real savings from a system on your roof.

We'll break down the key milestones, from the initial site assessment to navigating the final paperwork. This plan removes the guesswork and shows you exactly how to claim every dollar you're entitled to.

Step 1: Start With a Professional Site Assessment

Your solar journey begins with a professional evaluation of your property. This is more than a quick look at your roof; a proper site assessment is the foundation for designing a system that delivers the maximum financial return.

A solar expert will analyze several key factors:

- Roof Condition and Orientation: They will check the age and structural health of your roof and determine the optimal placement for panels to maximize sun exposure.

- Shading Analysis: They will map any potential shading from trees or nearby buildings that could reduce energy production.

- Energy Consumption History: Your past utility bills provide a blueprint for sizing a system that meets your property's energy needs without being oversized.

This initial consultation is your opportunity to ask questions and define your goals, whether it's achieving energy independence for your home in Suffolk County or slashing operating costs for your business in NYC.

Step 2: Choose a Qualified Installer

This is arguably the most important decision in the process. Partnering with a reputable installer like NY Essential Power is about more than just physical installation. We act as your guide, managing the complex paperwork to ensure you receive every available incentive.

A good installer handles the heavy lifting, including securing permits, filing for rebates, and managing interconnection agreements. This approach removes stress and prevents costly mistakes or missed deadlines that could jeopardize your savings.

A top-tier solar installer acts as your project manager. They coordinate with local utilities, manage NYSERDA applications, and prepare all necessary documentation, allowing you to focus on the benefits, not the bureaucracy.

Step 3: Navigate the Paperwork and Approvals

With a trusted partner, the administrative process becomes much more manageable. While your installer handles the bulk of it, it's helpful to understand what's happening behind the scenes. The process involves securing financial incentives and obtaining official permission to connect to the grid.

Here’s a look at the key paperwork involved.

Your Solar Incentive Application Checklist

This checklist breaks down the essential documents needed to claim your credits and rebates.

| Incentive | Required Action/Form | Typical Timeline |

|---|---|---|

| Federal Tax Credit | File IRS Form 5695 with your annual tax return | After system installation, during tax season |

| NY State Tax Credit | File NYS Form IT-255 with your state tax return | After system installation, during tax season |

| NY-Sun Rebate | Your installer submits the application to NYSERDA | Handled by installer before installation |

| Utility Interconnection | Sign the agreement provided by your utility (e.g., PSEG, Con Edison) | Handled by installer during project approval phase |

Your installer's role is to ensure these documents are completed accurately and submitted on time, locking in your savings without any surprises.

The timeline for approvals can vary, but a professional installer will keep you informed every step of the way. Filing the paperwork correctly and promptly is crucial for securing the best incentive rates.

Ready to put your plan into action? It all starts with a simple conversation. Contact NYS Essential Power today for a free, no-obligation solar assessment and proposal.

Got Questions About New York Solar Incentives? We've Got Answers.

Exploring solar energy in New York often raises many questions. That’s completely normal. To provide clarity, we’ve compiled straightforward answers to some of the most common inquiries we receive.

Can I Really Combine the Federal and State Solar Incentives?

Yes, absolutely! This is one of the greatest advantages of going solar in New York—the incentives are designed to work together, or "stack," to maximize your savings.

You can claim the full 30% Federal Solar Tax Credit on your system's total cost. In addition, you can claim the 25% New York State Tax Credit (up to $5,000) on the very same cost. This powerful combination significantly reduces your initial investment.

If I Lease a System, Do I Still Get the Tax Credits?

This is a critical distinction: No, you do not. To be eligible for these valuable tax credits, you must own your solar panel system.

When you lease solar panels, the third-party company that owns the equipment is the one that claims all the tax credits and incentives. While leasing may offer a low upfront cost, ownership is the only path to securing thousands in tax savings and increasing your property's value.

If your goal is the best possible financial return, owning your system is the clear choice. We can guide you through financing options that make ownership just as accessible as leasing.

What Happens If I Sell My House After Installing Solar Panels?

Selling a property with a solar system you own is a significant advantage. Studies consistently show that homes with solar panels sell for a premium and often more quickly than comparable homes without them. Your solar system is a valuable asset that is transferred to the new owner, much like a renovated kitchen or a new deck.

Furthermore, New York's Solar Property Tax Exemption means you enjoy that increased property value without a corresponding increase in your property taxes. It’s a true win-win, adding value now and making your home more attractive to future buyers. Highlighting the differences between solar and traditional energy can make this benefit even clearer to potential buyers.

Still have questions about how these incentives could work for your home or business? The team at NY Essential Power is here to help. Reach out today for a free quote and a personalized breakdown of your potential savings.

It’s Time to Take Control of Your Energy Future

For New Yorkers, energy independence is no longer a distant dream—it's an attainable goal, and the path is clearer than ever. By stacking the powerful solar panel incentives available in New York, you're not just making a smart financial decision; you're making a lasting investment in your property and our shared environment. This is about more than "going green"—it's about taking a stand against unpredictable and perpetually rising electricity costs.

Imagine locking in your energy costs for the next 25 years. That is the stability and peace of mind solar provides. When you combine the 30% federal tax credit with New York's generous 25% state credit, add any available NY-Sun rebate, and factor in the long-term savings from net metering, the financial benefits speak for themselves. This powerful combination is making solar a reality for homes and businesses from Long Island to Buffalo.

Your Path to Savings Starts With a Simple Step

For a homeowner, this translates to real money back in your budget every month. For a business owner, it means slashing operating costs and boosting your bottom line. With incentives this strong, there has never been a better time to make the switch.

Don't wait for another sky-high electric bill. Your journey to energy freedom and financial security is too important—and the rewards too significant—to put on hold.

Choosing solar is an act of empowerment. You're generating your own clean electricity, protecting your budget from a volatile energy market, and building a more resilient future. Let us show you exactly what that looks like for your property.

Ready to see your custom savings? Contact NY Essential Power for a free, no-obligation solar analysis. Our team will break down all the numbers, showing you how much you can save based on your unique property and energy usage. We’ll walk you through every incentive, every step of the way.

Start your journey to energy freedom today by visiting NY Essential Power's website.