Deciding how to pay for a solar project in New York is the most important step you'll take. The right financing transforms a major expense into a powerful, money-saving investment, offering both energy independence and significant environmental benefits. For both homeowners and businesses, the main commercial solar financing options boil down to owning the system (usually with a loan) or using a zero-down agreement like a solar lease or a Power Purchase Agreement (PPA). Each path has a very different impact on your bottom line.

Decoding Your Commercial Solar Financing Options

For any business or property owner in New York, going solar is a serious financial decision. The way you structure the deal dictates your upfront cost, long-term savings, and your level of responsibility for the system. This choice is the key that unlocks either immediate cost savings or the greatest possible return on investment over the system's life.

Think of it like choosing the right tool for the job. Your main goal might be:

- Maximizing long-term ROI by owning the system and claiming all the valuable New York and federal tax incentives.

- Preserving capital for other priorities by avoiding any upfront payment and achieving immediate cost savings.

- Simplifying operations with a hands-off approach where a third party handles all maintenance and monitoring.

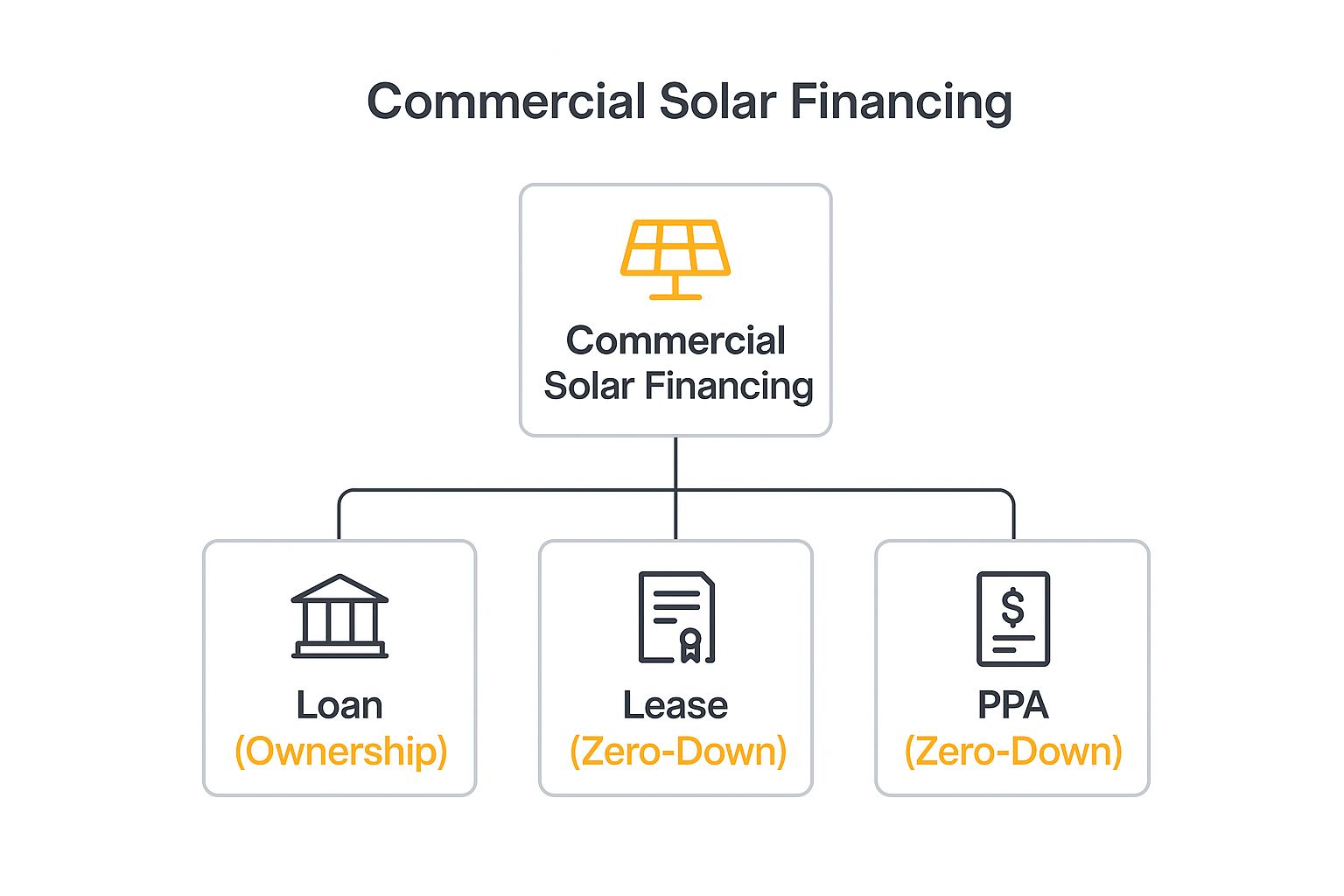

This infographic lays out the three main pathways businesses and property owners typically follow.

As you can see, a loan is the primary path to direct ownership. Leases and PPAs, on the other hand, are zero-down alternatives where a third party owns the system on your roof, making solar accessible to nearly everyone.

Understanding The Financial Landscape

The solar market is growing fast, and a big reason is the flexibility of these financing models. In fact, some projections show global capacity could expand by as much as 500 GWdc over the next decade. Financial products like PPAs and leases are fueling this growth by making solar accessible to businesses and organizations that couldn't otherwise afford the upfront cost.

The right financing aligns perfectly with your financial strategy, turning a potential capital expense into a predictable, value-generating asset. Whether you're a manufacturer in Syracuse or a homeowner on Long Island, the structure of your solar deal is paramount to achieving your goals of cost savings and energy independence.

For a deeper dive into the world of business borrowing, check out this definitive guide to commercial loans for business growth. And if you're a business in Suffolk or Nassau County, our team can walk you through a detailed analysis of what commercial solar on Long Island could mean for your finances.

Before we get into the details of each model, let's start with a quick overview.

Comparing Commercial Solar Financing Models at a Glance

This table offers a high-level look at the main financing options. It's a great starting point for seeing which route might align best with your immediate needs and long-term goals for cost savings and energy independence.

| Financing Model | Ownership | Upfront Cost | Best For |

|---|---|---|---|

| Direct Purchase (Cash/Loan) | You Own It | Highest (Full project cost) | Maximizing ROI, capturing all tax incentives, and having full control. |

| Solar Lease | Third-Party Owns | Zero or Low (Fixed monthly payments) | Budget predictability, avoiding maintenance, and immediate cost savings. |

| Power Purchase Agreement (PPA) | Third-Party Owns | Zero (Pay only for the power you use) | Reducing energy bills with no capital outlay and minimal risk. |

| PACE Financing | You Own It | Zero (Paid via property tax assessment) | Property owners with strong equity looking for long-term, transferable financing. |

Each of these paths has its own set of pros and cons. Now, let's break them down one by one so you can make a truly informed decision.

Solar Loans: Unlocking Full Ownership And Incentives

For many New York businesses and homeowners, the clearest path to solar isn't renting—it's owning. A solar loan makes that possible. The best way to think about it is like a mortgage for your energy future. You finance the asset, and once the loan is paid off, you own it outright. From that point on, you enjoy free, clean electricity for decades, achieving true energy independence.

This approach puts you firmly in the driver's seat of your power generation.

This financing path is a perfect fit for established businesses with a long-term vision, from manufacturing plants in Albany to commercial real estate in Westchester County. It’s for companies and property owners ready to make a smart investment for the highest possible returns and the greatest environmental impact. You're not just building equity in your property; you're building it in your energy supply, too.

The Power Of Full Ownership

When you own the solar panel system on your roof, you gain access to a powerful suite of financial incentives that aren't on the table with leases or PPAs. These perks don't just reduce the cost—they dramatically accelerate your return on investment, turning your solar array into a genuine financial asset.

The biggest advantage is capturing the full value of every tax credit and rebate. These tools were designed by federal and New York state governments to reward property owners for investing in their own clean energy infrastructure.

By owning your system, you transform a monthly energy expense into a capital investment that pays dividends through cost savings, tax benefits, and increased property value, all while reducing your carbon footprint.

This is a fundamental shift. You stop renting power from the utility and start owning your own personal power plant. Let's dig into the specific financial tools you can unlock.

Capturing Every Available Incentive

Using a loan to own your system is the only way to claim the most valuable commercial solar financing options for yourself. Stacking these different benefits is what makes the ROI so compelling for New York property owners.

Here are the key financial advantages:

- Federal Investment Tax Credit (ITC): This is the big one. The ITC allows you to deduct a massive 30% of your project's total cost directly from your federal taxes. On a $200,000 system, that’s a $60,000 credit coming right back to you.

- NY-Sun MW Block Program: This fantastic state-level incentive provides an upfront rebate based on your system's size. This cash-back payment, which varies by region from Long Island to Upstate, directly reduces the amount you need to finance.

- Accelerated Depreciation (MACRS): For businesses, the Modified Accelerated Cost-Recovery System (MACRS) lets you depreciate the value of your solar equipment on an accelerated five-year schedule. This creates a significant tax deduction that boosts your project’s financial performance.

When you combine these incentives, you can slash the net cost of a commercial solar project by 50-60% or more. This massive cost reduction makes the payback period much shorter and the long-term case for ownership undeniable.

Pros and Cons Of Solar Loans

While ownership offers the biggest financial upside and environmental benefit, it’s important to weigh the benefits against the responsibilities.

Key Advantages of a Solar Loan:

- Maximum ROI: You keep 100% of the energy savings and all tax incentives.

- Energy Independence: You control your own power production and are shielded from unpredictable utility rate hikes from companies like PSEG or ConEd.

- Increased Property Value: An owned solar asset directly increases your property's market value.

- Full Control: You choose the equipment and set the maintenance schedule.

Potential Considerations:

- Upfront Capital: While the loan covers most of the cost, a down payment may be required.

- Maintenance Responsibility: As the owner, you are responsible for the system's upkeep.

- Requires Tax Appetite: To fully benefit from the ITC and MACRS, your business needs to have enough tax liability.

Ultimately, choosing a solar loan is a strategic move to maximize long-term wealth and achieve true energy independence.

Leases And PPAs: Your Path To Zero-Down Solar Energy

For most businesses and homeowners in New York, the thought of a large upfront investment is the biggest hurdle to going solar. But what if you could get all the benefits of clean energy—cost savings, a lower carbon footprint—without spending a dime? That’s exactly what two of the most popular commercial solar financing options—solar leases and Power Purchase Agreements (PPAs)—are designed for.

The idea is simple: a solar developer, like NY Essential Power, installs, owns, and maintains a complete solar panel system on your property. You provide the roof or land and agree to use the clean power it generates. It’s a model built for immediate savings and zero hassle.

This hands-off approach has become the go-to solution for anyone who wants to preserve capital but is still serious about sustainability and cutting operational costs.

Solar Leases Explained

The easiest way to think about a solar lease is to compare it to leasing a car. You don't own it, but you get to use it for a fixed, predictable monthly payment. A solar lease is identical—you pay a flat monthly fee for the solar equipment on your roof.

That fixed payment is strategically set lower than your current average utility bill, so you start saving money from the very first month. This stability is a huge win for New Yorkers facing volatile energy prices, locking in your electricity costs for the entire lease term, which typically runs for 15 to 25 years.

Power Purchase Agreements (PPAs)

A Power Purchase Agreement (PPA) works a little differently. Instead of paying a flat rate to rent the equipment, you only pay for the actual electricity the solar system generates, just like a utility bill—but with one major difference: the price is much lower.

With a PPA, you agree to buy the solar power at a pre-negotiated, fixed rate per kilowatt-hour (kWh). This rate is almost always less than what ConEd or PSEG charges, which means you’re guaranteed to save money. If it's a cloudy month and the system produces less power, you simply pay less.

PPAs are especially powerful for businesses on Long Island and in New York City. The high utility rates in these areas mean the immediate savings from a lower, locked-in energy price can have an incredible impact on the bottom line.

The solar developer only gets paid when the system is producing power, so their goals are aligned with yours: to keep the system running at peak performance. This interest in high-performing decentralized energy is a global trend; learn more about the recent record-breaking investment in renewable energy.

Key Benefits of Zero-Down Options

Both leases and PPAs offer serious advantages, especially for those who want to protect cash flow and keep things simple.

Here’s a quick rundown of the main perks:

- Zero Upfront Cost: Switch to solar without any capital investment, freeing up cash for other priorities.

- Immediate Savings: From day one, your new solar payment is designed to be lower than your old utility bill.

- No Maintenance Headaches: The developer is 100% responsible for all monitoring, maintenance, repairs, and insurance.

- Protection From Rate Hikes: By locking in your energy rate, you shield yourself from the constantly rising costs of utility power.

What’s the Tradeoff?

The compromise with leases and PPAs is that you don't own the system. The solar developer is the one who claims the valuable federal and state tax incentives. This is the central bargain: you trade the long-term financial upside of ownership for immediate cost savings and zero responsibility. For non-profits, schools, or government buildings with no tax liability, this makes PPAs a perfect fit.

Using PACE Financing For Your Property

Beyond standard loans and leases, there is a powerful tool for commercial solar financing called PACE. It stands for Property Assessed Clean Energy, and it’s a game-changer for property owners in many New York areas looking to fund major energy projects.

Instead of a traditional business loan, PACE treats the solar project as a long-term improvement to the building itself. This lets you finance 100% of the project's cost and pay it back over a long period—often up to 30 years—through an assessment added to your property tax bill. It's a clean, straightforward way to get a project done without impacting your operating cash.

This approach completely reframes the financial side of going solar for property owners.

How C-PACE Works for New York Businesses

Commercial PACE (C-PACE) is built around the property, not the owner. The financing is tied directly to the building, so if you sell, the obligation transfers seamlessly to the new owner, who also gets to enjoy the lower energy bills. This solves a major headache for owners who want the benefits of solar but might not hold the property for the system's full 20- or 30-year life.

Because the repayment terms are so long and there’s no money down, a C-PACE project can often be cash-flow positive from day one. The money you save on electricity each year can be more than the annual PACE payment, putting money back in your pocket immediately.

This setup is a huge win for commercial landlords in cities like Buffalo, industrial operators in Syracuse, or any business that wants to make a smart capital improvement that boosts property value while slashing overhead and contributing to a greener New York.

Who Benefits Most From PACE Financing

C-PACE is a powerful tool that shines in a few key situations.

You might be a perfect fit for C-PACE financing if:

- You're a commercial landlord. You can pass on the costs (and the energy-saving benefits) to tenants or simply transfer the assessment when you sell.

- You're thinking long-term but want an exit strategy. You get all the perks of owning a solar system without tying up business credit.

- You have a big project in mind. PACE can cover more than just panels. Need to bundle in new energy-efficient windows or an HVAC upgrade? You can roll it all into one payment.

Essential PACE Considerations

The main hurdle for PACE is getting consent from your mortgage lender. Because the PACE assessment is a tax lien, it takes priority over the mortgage, so your bank has to sign off. This is a standard step, and our team at NY Essential Power has experience helping clients navigate these conversations.

By using your property's value as the foundation, C-PACE gives you a secure, long-term path to energy independence. To learn more, explore our full range of blog articles and get in touch with our commercial solar experts.

Maximizing Your ROI With New York Solar Incentives

Picking the right financing option is just one part of the puzzle. The other is knowing how to stack New York's powerful solar incentives to shrink your project cost and supercharge your return on investment.

Think of these programs as a set of financial tools designed to work with your loan, lease, or PPA. For any property owner in the state—whether you’re running a winery on Long Island or a factory near Rochester—layering these incentives is the secret to achieving your goals of cost savings and environmental benefit.

The Federal Solar Investment Tax Credit (ITC)

The heavyweight champion of solar incentives is the federal Solar Investment Tax Credit (ITC). It’s not a deduction; it's a dollar-for-dollar credit that directly reduces your federal tax bill. For any business or individual with a tax liability, this is a game-changer.

Currently, the ITC lets you claim 30% of your total solar project cost. On a $300,000 commercial system, that’s a clean $90,000 you get to keep. This one credit alone can wipe out nearly a third of your cost, dramatically shortening the time it takes for the system to pay for itself.

New York State's Signature Programs

On top of the federal credit, New York offers its own powerful incentives, making it one of the best states for going solar. The real magic happens when you combine these with the ITC.

- NY-Sun Megawatt (MW) Block Program: New York's cornerstone incentive is an upfront cash rebate that immediately lowers your system's price tag. The amount depends on your project's size and location, with different "blocks" of funding for regions like Con Edison territory and Long Island.

- Modified Accelerated Cost-Recovery System (MACRS): While federal, MACRS is essential for any New York business that owns its solar array. This rule allows you to depreciate 85% of your solar asset's value over an aggressive five-year schedule, creating a massive tax deduction.

When you layer the NY-Sun rebate, the federal ITC, and MACRS depreciation, a business can often slash the net cost of a commercial solar project by over 60%. This is how a smart, long-term energy investment turns into a short-term financial win.

To clarify how these pieces fit together, here’s a quick overview of the key incentives available.

Key Solar Incentives for New York Businesses

| Incentive Name | Governing Body | Type of Benefit | Key Detail |

|---|---|---|---|

| Investment Tax Credit (ITC) | Federal (IRS) | Tax Credit | 30% of the project cost as a dollar-for-dollar tax reduction. |

| NY-Sun MW Block Program | NYSERDA | Upfront Rebate | A per-watt cash incentive that lowers the initial system cost. |

| MACRS | Federal (IRS) | Accelerated Depreciation | Depreciate 85% of the system's value over just five years. |

| NYS Tax Credit for Solar | New York State | Tax Credit | 25% of the project cost for residential, up to a cap of $5,000. |

This table provides a snapshot, but weaving them into a coherent financial strategy is where the real value lies.

Why Incentives Are More Important Than Ever

Solid government incentives provide a much-needed buffer against market volatility. The commercial solar world has seen some big shifts, with corporate funding recently plunging 39% year-over-year. You can read more about how market disruptions are affecting solar financing.

This uncertainty makes New York’s reliable incentives all the more valuable. They act as a stable foundation, ensuring that going solar remains a smart, predictable move towards energy independence.

Navigating these programs takes real expertise. Our team at NYS Essential Power lives and breathes this stuff. To see how we’re helping people across the state, check out our full range of blog articles.

Choosing The Right Financial Path For Your Business

Navigating the world of commercial solar financing can feel overwhelming, but finding the right fit comes down to a few key questions about your finances and future goals.

The perfect path for a profitable manufacturer in Rochester will look different from the ideal solution for a non-profit in Albany or a homeowner in Westchester. By taking a hard look at your unique situation, you can turn a complicated decision into a clear, strategic choice.

The decision boils down to three things: your available cash, your tax situation, and your property plans.

Assessing Your Capital and Tax Appetite

First, do you have cash for a down payment, or do you need a solution with zero money down? If you want to keep your cash free, a solar lease or a PPA is where you should start. Both options give you immediate savings without a big check upfront.

Next, can your business or household use a large tax credit? A profitable company or a homeowner with a federal tax bill is a perfect candidate for a solar loan. Ownership is key to claiming the 30% ITC and taking advantage of other benefits, which creates huge financial value.

On the other hand, for a tax-exempt organization like a school, church, or municipality, those tax credits are worthless.

For a tax-exempt non-profit in Albany, a PPA is the perfect fit. It offers immediate savings on electricity bills without needing a tax appetite to be financially viable, helping them achieve their environmental goals.

This is a critical fork in the road and, for many, it makes the decision simple.

Aligning with Your Long-Term Property Plans

Finally, what are your plans for the building? If you own your facility and aren’t going anywhere, investing in ownership through a solar loan builds real equity. This is a common play for established manufacturers and long-term homeowners across New York.

But what if you lease your space or might move in a few years? A PPA or lease offers more flexibility. Similarly, C-PACE financing is a fantastic tool for property owners who might sell, because the financing is tied to the building and transfers seamlessly. It's smart to think about how solar fits into the bigger picture; you might even explore broader modernization strategies for SMBs that often go hand-in-hand with sustainable energy.

Finding Your Perfect Financing Match

Let's pull this all together with a quick example.

- Scenario: A profitable manufacturing company in Rochester owns its facility and has a strong balance sheet.

- Best Path: A solar loan is the clear winner. This company has the tax liability to fully benefit from the ITC and MACRS, which will deliver the greatest long-term wealth, the highest possible ROI, and maximum environmental impact.

The best financing option is the one that lines up perfectly with your goals. The only way to know for sure is to see a customized financial analysis built just for you.

Ready to find the perfect financial path for your solar project? Request a custom quote by contacting NY Essential Power today and let us build a solution that works for your bottom line.

Solar Financing FAQs: Your Questions Answered

It's smart to have questions when you're exploring a solar project. Let's break down some of the most common things New York property owners ask when weighing their commercial solar financing options.

Can I Combine New York Solar Incentives With Any Financing Option?

Yes, but how you benefit changes. If you buy the system with a loan, you directly claim the tax credits and rebates. With a PPA or lease, the third-party owner gets those incentives and uses that financial boost to offer you a much lower monthly electricity rate.

It’s the classic trade-off: direct ownership means you get the tax perks, while zero-down options pass the savings along to you through a lower bill.

How Much Does My Business Credit Score Matter?

Your credit history plays a big role, particularly for a solar loan. A strong credit score helps you secure a lower interest rate and better terms, boosting your long-term return. For PPAs and leases, credit is still part of the picture, but requirements can be more forgiving since the developer owns the equipment.

Think of your credit score as the key that unlocks better terms. A higher score almost always means lower financing costs and a faster payback on your solar investment.

What Happens If I Sell My Building While I Still Have a Solar Lease or PPA?

This is a common question with a simple answer. Solar leases and PPAs are designed to be transferable to the new building owner. The solar provider handles most of the paperwork for a seamless handover. The new owner picks up the agreement and starts saving on energy from day one—a great selling point for your property.

Can I Switch From a PPA to Owning the System Later?

Absolutely. Most PPA contracts come with a buyout option, giving you the right to purchase the solar system at a set price at specific times, usually after year six or seven. This offers great flexibility. You can start with a zero-down PPA for immediate savings and then move to full ownership when you are in a position to take on the asset.

Ready for clear answers and a customized plan to achieve cost savings, energy independence, and your environmental goals? The team at NY Essential Power can run a detailed financial analysis to find the perfect solar solution for your home or business. Contact us today to request your free quote and see what's possible.